Buying Apartment Properties

HUD Multifamily Loans - The Complete Guide

HUD/FHA Multifamily Loans are underwritten, approved, and guaranteed by the Department of Housing and Urban Development (HUD) which does not provide the financing. This is done by HUD approved lenders. Qualified property types include Apartment buildings, Senior Housing (62-year-old plus), Intermediate Care, and Assisted Living Facilities. HUD Multifamily Loans have the longest fixed rate terms of 35 to 40 years, the highest LTV’s, and lowest fixed rates.

Buying Multiple Houses with a HUD/FHA Loan

Buying multiple houses with a HUD/FHA loan for the purpose of renting them is not allowed. An FHA residential loan can be used to purchase a duplex, triplex or fourplex and renting units out is allowed as long as the applicant occupies one of the units. HUD multifamily will not finance 1 – 3-unit properties in any configuration. However, HUD will finance 2 or more contiguous fourplexes on one or individual tax lots.

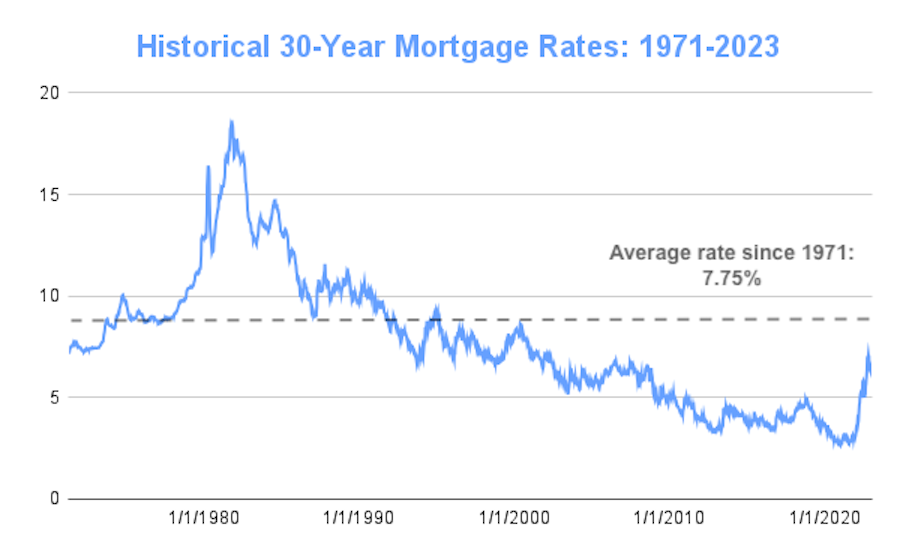

2023 Commercial Interest Rate Outlook

By Terry Painter/Mortgage Banker, Author of “The Encyclopedia of Commercial Real Estate Advice”.

January 1, 2023

Low Cap Rates and High Interest Rates Explained

March 23, 2023

By Terry Painter/Mortgage Banker, Author of: “The Encyclopedia of Commercial Real Estate Advice” Wiley Publishers

Why Apartment Building Prices are Going Down

March 8, 2023

By Terry Painter/Mortgage Banker, Author of “The Encyclopedia of Commercial Real Estate Advice” Wiley Publishers

Raising Money for Multifamily Properties - for Beginners

By Terry Painter/Mortgage Banker, Author of “The Encyclopedia of Commercial Real Estate Advice”, Wiley Publishers. Member of The Forbes Business Council

THE SHOCKING TRUTH ABOUT CAP RATE

Cap Rate stands for capitalization rate and is used in commercial property valuations. Cap Rate is simply the net operating income (income minus expenses) divided by the purchase price or appraised value.

Commercial Real-Estate - A Great Investment

August 30, 2017

If you have money to invest, read this article. Why? It tells you a number of reasons for commercial Real-Estate being a great investment. Some think it’s the number one investment of all investments.

Let’s get right to it:

1. The Power of Leverage –

CLOSING 97% OF OUR MULTIFAMILY LOANS AS PROPOSED

Getting the right loan and the lowest rate requires wisdom and finesse. If you’re ready to partner with a team of professionals who’ve built a foundation on straight talk and true strategy, we are the loan store for you.

28+ YEARS OF OVER-DELIVERING VALUE.

HUD Loans are one of the best options with the current level of interest rates. For a complete guide to HUD Multifamily Loans please go here: