2023 Commercial Interest Rate Outlook

By Terry Painter/Mortgage Banker, Author of “The Encyclopedia of Commercial Real Estate Advice”.

January 1, 2023

The Truth About How Long Term Commercial Rates are Determined

Sorry if this article starts out boring because I’m about to throw a lot of numbers at you. But before I do, I will disclose that it looks like rates are going to stay high in 2023. Over the past year to lower inflation, the Feds have raised short term interest rates 8 times. We are talking about the Federal Funds Rate and Prime Rate. During this time the Federal Funds Rate (the rate the Feds lend to banks) went from .25% to 4.50%. Jamie Dimon, the chairman of Chase Bank, predicts that this rate will go up to 5% and perhaps even 6.00% if there is a recession by the end of 2023. https://www.cnbc.com/2023/01/19/jamie-dimon-says-rates-will-rise-above-5percent-because-there-is-still-a-lot-of-underlying-inflation.html Prime rate also goes up with each increase by the Feds and over the past year has gone from 3.25% to 7.50%.

So, is the Feds’ raising short term rates at breakneck speeds the cause of long-term rates going up so much over the past year? Most people certainly think so, but the answer is actually “kind of”. Long term rates are not set to automatically go up when short term rates rise. But indirectly, they do follow the direction of short-term rates. This is because when the federal funds rate goes up, the 10-year treasury yield seems to always follow which is tied directly to long term rates as you will see in the next paragraph.

All long-term commercial fixed rates (residential too) are calculated by starting with a real time US Treasury Yield Index and adding to this a margin. Let’s use Fannie Mae’s 10-year fixed multifamily rate as an example. On December 19, 2021, the 10 Year Treasury Index was at 1.37%. Fannie then added a margin of 2.20% for a rate of 3.57%. Today the 10-year treasury is at 3.41% and Fannie has added a margin of 2.16% for a rate of 5.57%. Residential rates are even higher with the average 30-year fixed at 6.33% today. On October 20,2022, the ten-year yield was at 4.33% and the margin was at 2.52% for a whooping all-in rate of 6.85%.

To make matters worse, most lenders create a double whammy by raising the margin when treasuries go up to counter a higher perceived risk. It would be nice if they did the opposite – right?! So that is the truth on how long-term mortgage rates are derived. To find out more about this process in detail, you can refer to the section in my book: “The Truth About How Commercial Lenders Set Rates, Terms and Fees”.

Why Have Long Term Mortgage Rates Soared?

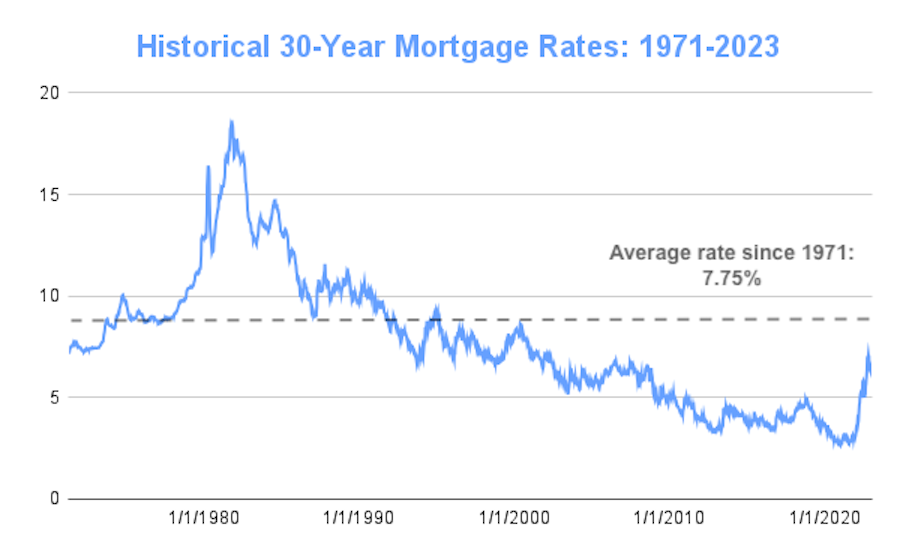

Long term mortgage rates have come down the past two months which is a good sign that they will not got up to the high sixes again in the near future. But with the Feds raising rates as their main weapon to fight inflation throughout 2023, they will continue to raise short term rates. This as mentioned has a trickle up effect on long term rates.

The Feds have some other weapons in their bag of tricks. They purposely kept mortgage rates artificially low by purchasing massive amounts of treasury bonds during the great recession, and again during the coronavirus recession. Their goal was to stimulate the economy and increase inflation which was close to zero. By purchasing as much as $80 billion per month in treasury bonds, they increased the demand, which lowered treasury yields, which lowered long term mortgage rates. At the same time, they purchased large amounts of mortgage back security bonds to add more liquidity and further reduce mortgage rates. Yes, both these practices are the same as printing money and added massively to the federal deficit. The Feds ended this practice in March of 2022, which – what do you know? – just happens to coincide exactly with when long term rates started going up.

Long Term Commercial Mortgage Rate Predictions for 2023

At the writing of this article, long term mortgage rates are continuing to decline slowly as a reflection of the 10-year treasury yield coming down. With inflation cooling slowly to 6.5% in December 2022 from a high of 9.1% in July of 2022, the Feds may elect to only increases rates .25% to .50% at their next meeting on January 30 – February 1, according to Reuters: https://www.reuters.com/markets/us/fed-could-hike-rates-by-25-or-50-basis-points-feb-1-daly-tells-wsj-2023-01-09/ The conclusion here is that long term rates will continue to go up this year until inflation dips to the Feds’ sweet spot of around 2%.

Connecting the dots, I predict that long term commercial rates will seesaw a bit through the first half of 2023 and reach a low of 5.2%. Then if inflation doesn’t cool off enough they will increase during the second half to 5.7%. According to CNBC, most economists are predicting a recession in 2023: https://www.cnbc.com/2022/12/23/why-everyone-thinks-a-recession-is-coming-in-2023.html If this happens and inflation doesn’t cool enough, commercial rates will likely climb above 6% as the year goes on with residential rates climbing even higher. So don’t expect to see rates in the mid to high threes again for a long time.

Category

- Analyzing Apartment Property Income

- Apartment Building Appraisals

- Apartment Loan Rates

- Apartment Loans

- Buying Apartment Properties

- Buying Bank-Owned Apartment Properties

- New Construction Apartment Loans

- Qualifying for Apartment Financing

- Selling Your Apartment Property

- Wealth Strategies for Apartment Investing

CLOSING 97% OF OUR MULTIFAMILY LOANS AS PROPOSED

Getting the right loan and the lowest rate requires wisdom and finesse. If you’re ready to partner with a team of professionals who’ve built a foundation on straight talk and true strategy, we are the loan store for you.

28+ YEARS OF OVER-DELIVERING VALUE.

HUD Loans are one of the best options with the current level of interest rates. For a complete guide to HUD Multifamily Loans please go here: