Apartment Loan Rates

HUD Multifamily Loans - The Complete Guide

HUD/FHA Multifamily Loans are underwritten, approved, and guaranteed by the Department of Housing and Urban Development (HUD) which does not provide the financing. This is done by HUD approved lenders. Qualified property types include Apartment buildings, Senior Housing (62-year-old plus), Intermediate Care, and Assisted Living Facilities. HUD Multifamily Loans have the longest fixed rate terms of 35 to 40 years, the highest LTV’s, and lowest fixed rates.

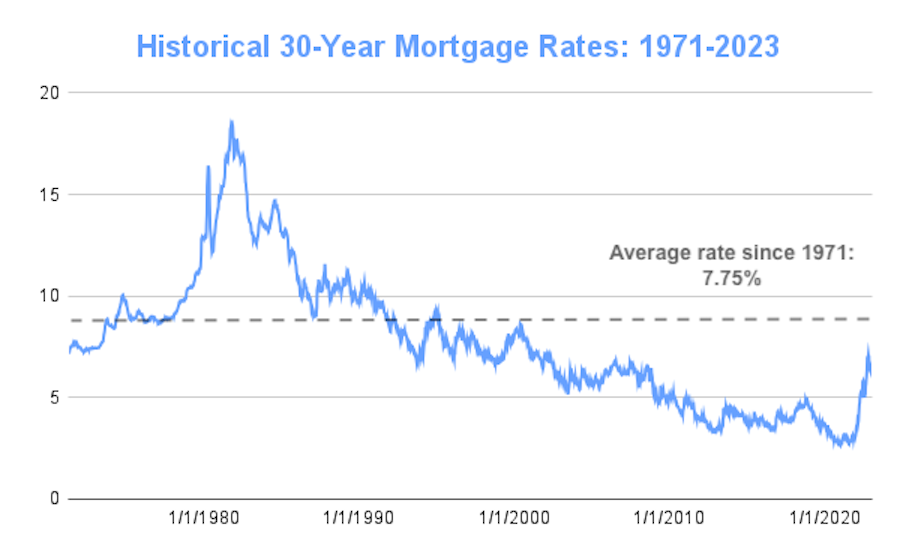

2023 Commercial Interest Rate Outlook

By Terry Painter/Mortgage Banker, Author of “The Encyclopedia of Commercial Real Estate Advice”.

January 1, 2023

Commercial Property Mortgage Rates: How Do They Work?

And how do they differ from residential mortgage rates? We will also be looking at terms, because terms work so closely with rates.

Commercial property rates work quite differently from residential property rates. Generally with commercial property rates, the higher the number of years of a loan, the higher the interest rate, while with residential property rates, the higher the number of years of a loan equals a lower interest rate.

Low Rates: Always the Most Important Feature? Part 2

June 10, 2015

Going for the lowest rate could be a good practice generally. But, as we covered in the previous blog, there are quite a few lenders who quote a rate too low to hook you into working with them. Later on when you are well into the loan process, they give you a higher rate than originally quoted. They may tell you that rates have gone up, but the problem is they changed the rate artificially to try to get your business.

This most recent past article also covered what you can do to help prevent this from happening.

Low Rates: Always the Most Important Feature?

No.

Why? Even though there are arguments lenders could give you that you should go with them because they are quoting you a low rate at the inception of the loan process – the low rate quite possibly is deceptive.

A lender can quote you anything they want to quote you at the beginning of the loan process. Because you are not trained in commercial loans, whatever they quote you, you very well could believe.

Fannie Mae Apartment Loan, The Best in America, Part 2

December 17, 2014

Last week, this blog was about 5 reasons why the Fannie Mae apartment loan is the best in America. If you are in the market for apartment loans, you need to be familiar with the Fannie Mae program.

There are so many multifamily investors who don’t know about the Fannie Mae program. Many of them use banks only and are not aware of this great program.

The second part of this blog is about how to qualify for a Fannie Mae loan.

But first, here is a summary of last week’s blog:

Fannie Mae Apartment Loan, The Best in America

December 03, 2014

The Fannie Mae apartment loan is the best apartment loan in America.

A Fannie Mae loan is a loan that is not the traditional bank loan. It is a government backed loan also referred to as an agency loan.

Why is a Fannie Mae apartment loan the best apartment loan in America?

CLOSING 97% OF OUR MULTIFAMILY LOANS AS PROPOSED

Getting the right loan and the lowest rate requires wisdom and finesse. If you’re ready to partner with a team of professionals who’ve built a foundation on straight talk and true strategy, we are the loan store for you.

28+ YEARS OF OVER-DELIVERING VALUE.

HUD Loans are one of the best options with the current level of interest rates. For a complete guide to HUD Multifamily Loans please go here: