Apartment Loans

HUD Multifamily Loans - The Complete Guide

HUD/FHA Multifamily Loans are underwritten, approved, and guaranteed by the Department of Housing and Urban Development (HUD) which does not provide the financing. This is done by HUD approved lenders. Qualified property types include Apartment buildings, Senior Housing (62-year-old plus), Intermediate Care, and Assisted Living Facilities. HUD Multifamily Loans have the longest fixed rate terms of 35 to 40 years, the highest LTV’s, and lowest fixed rates.

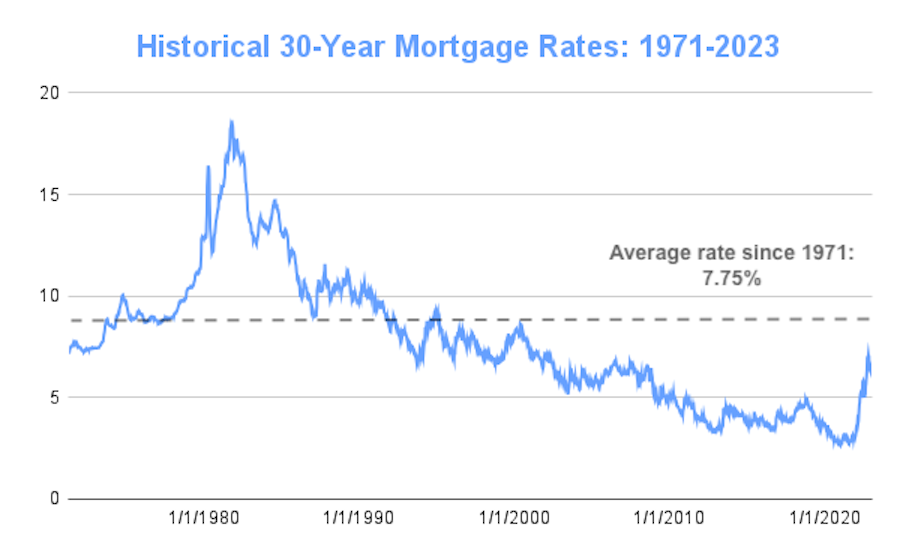

2023 Commercial Interest Rate Outlook

By Terry Painter/Mortgage Banker, Author of “The Encyclopedia of Commercial Real Estate Advice”.

January 1, 2023

How to Value an Apartment Building in 15 Minutes

By Terry Painter/Mortgage Banker, Author of “The Encyclopedia of Commercial Real Estate Advice” – Published by Wiley, Member of The Forbes Real Estate Council

Try one or all 4 of these ways to value an apartment building in 15 minutes:

THE SHOCKING TRUTH ABOUT CAP RATE

Cap Rate stands for capitalization rate and is used in commercial property valuations. Cap Rate is simply the net operating income (income minus expenses) divided by the purchase price or appraised value.

How do you Finance an Apartment/Multifamily Building?

In Short, it takes these 5 components to finance an Apartment Building:

CLOSING 97% OF OUR MULTIFAMILY LOANS AS PROPOSED

Getting the right loan and the lowest rate requires wisdom and finesse. If you’re ready to partner with a team of professionals who’ve built a foundation on straight talk and true strategy, we are the loan store for you.

28+ YEARS OF OVER-DELIVERING VALUE.

HUD Loans are one of the best options with the current level of interest rates. For a complete guide to HUD Multifamily Loans please go here: